Do you know which is the most important thing for financial freedom?

– Earning a lot or saving a lot.

In fact, both are important but most important is how you manage your hard-earned money and avoid the common money mistakes that almost everyone did in the initial days.

I started earning when I was just 19 and also did some common mistakes that I am going to talk about in this post,

so that you can avoid these common financial mistakes at your early age.

Though I am not a financial advisor or expert but sharing with you the tips that I learned from my mistakes as well as from some professional advisors.

Common Money Mistakes

1. Buying Insurance Policies For Investment Purposes

As per CA Govind M Chandak, this is one of the most common mistakes that 95% of people make and invest in insurance plans to get a return in the future.

According to him, very few people understand the difference between term plans, endowment plans, etc. In India, out of 100 people, almost 95 commit this mistake.

Traditional insurance plans do not offer sufficient insurance cover and also not provides very good returns.

Most of us are lured by the hefty benefits of tax benefits, but buying insurance policies to save on tax liability is not a good idea anymore.

The real objective of the insurance plan is the insurance cover offered in case of death or accident but the primary focus of investors in the majority of cases is the tax deduction.

These plans may look promising but once you analyze them, you will find that the returns are more or less 5%, which is of course is not a good return.

2. Buying Things Just Because They Are On Discount /Sale

Sometimes we don’t actually need the things but end up buying them because of FOMO (Fear Of Missing Out). We consider the limited-time Sale as an opportunity and grab it before it ends.

Many people would rather make an impulse purchase during the sale so that they do not regret it later.

The psychology behind FOMO marketing works because we are afraid of missing out on this chance to save tons of money as if it might never come again; however, we end up spending the money instead of saving them.

From Amazon’s Great Indian Sale to Flipkart’s The Big Billion Days or Walmart’s Clearance Sale to AliExpress’s Black Friday Sale, everyone becomes crazy to buy things just because it is on discount.

But the funny thing is that now you will find such sales every other month with different names.

3. Buying Stocks Based On Tips Without Any Knowledge Of Market

You will find every Tom, Dick, and Harry giving stock tips over Facebook, WhatsApp, and TV. Unfortunately, a lot of people fall into the trap and invest money without any knowledge.

What is the end result? They lose everything! Often the sharp fall in the stock markets shakes investors and so is the sudden rise.

Even blue-chip companies and their stocks and index stocks have not remained unaffected.

Mutual funds may be an investment option but it will not cut the risk entirely, but risks are minimized.

Ideally, investment in diversified equity funds focused on different segments gives the portfolio all the diversification it needs and reduces the risk.

The golden principle is never to keep all your eggs in one basket as also said by great investor Warren Buffett.

4. Becoming A Victim Of Lifestyle Inflation

Lifestyle inflation means that when you receive a profit in business or a hike in your salary, you tend to spend it for a better lifestyle, which may not be necessary.

Income hikes are always followed by better lifestyles, by buying the latest and most expensive mobile phones, electronic gadgets, designer clothes, and the list goes on.

Moving from 2bhk home to 3bhk just because you have got a good hike, and upgrading your car because you have got some bonus are some of the examples of lifestyle inflation that destroys financial lives.

Lifestyle inflation can negatively impact your finances. This may give you short-term happiness but is a bad financial decision against your financial goals.

Jacqueline Curtis also suggests spending less when you earn more to avoid lifestyle inflation. Avoiding lifestyle inflation means that you don’t increase your purchases when you receive a hike or profit. Instead, you make plans for that extra money and use it to build your financial security further.

5. Procrastinating Investment Decisions

Procrastination means – To keep delaying something that must be done, often because it is unpleasant or boring.

This highlights two important aspects –

1. The thing which is being procrastinated is important, and

2. The thing is being procrastinated can be boring.

Investment decisions can be boring for someone. However, I am sure you would agree that Financial Decisions are necessarily important for all of us.

All of us face the problem of how to start. Let it be going to the gym or investing. We face this problem everywhere.

Procrastinating our investment decisions is very common. The initial hiccup can be due to various reasons like excessive choices in the market to choose from or the fear of making a wrong decision.

How to avoid procrastination in financial decisions?

Unmesh Deshmukh of MoneyUncle.com says that sometimes procrastination becomes a habit. It is because the decision or the tasks are not attractive enough to be performed immediately.

So you have to constantly train yourself that the boring decision and tasks are good in the long run. So you have to complete the boring tasks first and then the exciting ones.

6. Not Able To Crack The Credit Card Mystery

Credit card companies /banks profit only if you miss payment within the due date or choose to pay the minimum amount due.

If you are in the habit of paying the minimum amount due to your credit card payment, then you are trapped in a credit card mystery.

Also, there are very few people who really enjoy the credit card benefits like free lounge access, buy one get one movie ticket, etc.

So before you apply for a credit card, you must check the features that are suitable to your requirements and not just the credit limit.

7. No Idea About The Power Of Compounding

As Albert Einstein famously said,

“Compound Interest is the 8th wonder of the world. He who understands it earns it; he who doesn’t pays it.”

Most people have no idea about the tremendous power of compounding to grow wealth.

Everyone has come across the formula of compounding, but very few people really understand its power.

This is why people do not start saving early and hence lose out on the power of compounding.

Compounding occurs when the returns or interest generated on the principal amount in the first period is added back to the principal amount to calculate the following periods’ interest.

How do get benefited from the power of compounding?

According to Groww.in below are three tips to get benefited by compounding:

- Start investing early, better from the time you start earning.

- Maintain discipline and create a healthy portfolio.

- Be patient and keep a long-term investment mindset.

8. No Track Of Cash Flow

Cash flow basically means the movement of money in and out in terms of your income and expenditure.

Ideally, we want to have a positive cash flow – meaning that more money is coming in and less goes out. If you have a positive cash flow, your will be able to invest more in your financial growth.

However, very few people keep track of their cash flow. Most of them just don’t know where the money is gone.

9. No Emergency Budget

Most of us do not understand the necessity of the emergency or contingency budget; which would be your lifesaver during any uncertain situation.

Sometimes not having any emergency budget results in embarrassing situations of borrowing money from friends and relatives.

Some people even break their FDs and other investments to meet the emergency requirements, which is the biggest financial mistake.

One should save enough for the basic necessities of life as well as for any emergencies. Keeping a contingency budget for any future eventuality should always be kept in mind so that you should have an emergency or contingency budget for the rainy days.

Today life has become most uncertain and there is always a fear of losing a job or loss in the business.

Advisers suggest having at least six months’ expenses stashed away in safe and easily accessible instruments like liquid funds and fixed deposits. But given the covid-like situation, experts now advise having 12 to 24 months of expenses in liquid funds for emergencies.

10. No Medical Insurance

Now healthcare cost is rising day by day, and it is impossible to manage them without insurance.

One accident can shatter all our financial dreams. People are even losing their lifetime savings just because they did not take medical insurance.

At least one medical insurance for self and family members should be a must for all. So that during any medical urgency, you need not break your regular savings.

11. No Financial Plan or Goal

A well-defined financial plan is essential for a secure future.

ClearTax.in defines Financial Planning as the process that provides you a framework for achieving your life goals in a systematic and planned way by avoiding shocks and surprises.

People do not know why they need to save money because they don’t know their financial goals.

No financial planning means bigger financial risks. Identifying proper financial goals and planning to achieve them systematically is the heart of financial planning.

12. No Diversification of Funds

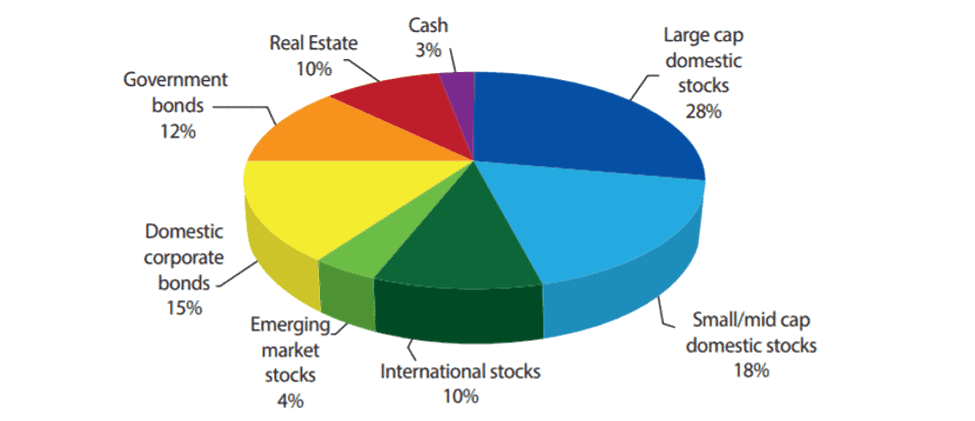

Diversification is a strategy that aims to mitigate risk and maximize returns by allocating investment funds across different vehicles, industries, companies, and other categories.

Very few people understand the right way of diversifying investments. By diversifying, you’re making sure you don’t put all your eggs in one basket.

Some people would invest all their money in real estate; some would invest all the money in gold; some would just keep it in the locker; some would invest all the money in the stock market. These are the wrong ways to invest in only one financial instrument.

A diversified investment portfolio includes different asset classes such as stocks, bonds, and other securities. Example of a typical diversified portfolio:

13. Spending All The Hard Earned Money On Children’s Marriage

Mostly in Indian society, people save their entire life just by spending all the money on random relatives who only bother about the food and arrangements.

Children’s marriage is always on the top of the financial goals for parents.

Ideally, parents should give more emphasis on children’s education and their own retirement plan rather than children’s weddings.

14. Buying Excessive Gold Only To Keep It In The Locker

Gold worth lakhs is kept in lockers only to be used once or twice a year. This is resulting in the money getting blocked and hence not getting any returns on it.

Bank lockers are safe, but the safer option is to insure them, as banks do not provide any locker insurance to their customers. Only private players (insurance companies) can help customers with insurance policies, but that will not give you any return.

So experts advise investing in Gold ETF or Exchange Traded Fund, which is a commodity-based Mutual Fund. So you will get returns and no worry about getting lost or paying the locker fee.

15. An Extremely Conservative Approach To Investment

Traditionally, people have been risk-averse. They would just have an FD and live on 6–7% annual interest. Some would just keep the cash at home.

As per Personal FN, you need to strategically invest in mutual funds starting from your younger age, which will help counter inflation well.

Investing in fixed deposits, or buying endowment plans cannot help you accomplish your financial goals effectively.

16. Lack Of Clarity Between Asset And Liability

Both assets and liabilities tend to play a vital role when it comes to evaluating your overall wealth.

Assets add value to your wealth and increase your equity, while liabilities decrease your wealth value and equity.

Having a car is not an asset because it consumes fuel and has a maintenance cost. Its price will only depreciate in the future.

A car is a necessity but people spend a lot of money and even take loans to buy a luxury car over and above their budget.

Experts suggest investing in assets that provide a future benefit or give you a good return.

17. Spending A Lot Of Money On Unnecessary Stuff

Sometimes just to look different from others, people tend to spend a lot that actually is overpriced.

A luxury car, a big house, a fancy watch, a fancy vacation. People want fancy stuff and are willing to pay a premium amount irrespective of the value it generates.

In fact, you may be wasting money in extremely common but often overlooked ways. Some of them are:

- Buying Brand Name Products

- Extended Warranty Of Product or Services.

- Cellphone Accessories

- Mobile Phone Upgrades (iPhone 11 to iPhone13)

- Excessive use of Credit Cards

18. Lack Of Disciplined Investment

Instead of spending what is left after investing, people invest what is left after spending. This results in undisciplined investment.

Discipline in investing is about forming good habits and then doing them consistently.

Rick Ferri, a former contributor to Forbes, put together six rules for disciplined investing:

- Have a long-term investment mindset.

- Form a diversified asset allocation based on long-term goals.

- Select low-cost funds (a mix of the index and exchange-traded funds) in the allocation.

- Maintain this portfolio through all market conditions.

- Don’t change the asset allocation due to recent market activity and think long-term.

- Don’t hold back on new investments while waiting for market clarity. Make it consistently and patiently.

19. Wasting Time On Unproductive Things

Rather than learning new stuff and growing their skillset, people end up wasting time on social media, YouTube, and Netflix.

We all know that “Time is Money”, but very few people really understand this. Being aware of where your ‘time suckers’ are is the first step to making the most of your available time.

A good way to measure this is to look at how you are spending your time each day. Have a check on your time wasted on social media, gossip, and other unproductive stuff.

Instead, utilize your time more constructively by learning new stuff and upgrading your skills.

20. Getting Too Greedy With Investment

People blindly invest their money in penny stocks, day trading, futures, and options. They eventually lose all their hard-earned money.

What is the root cause? It’s GREED

Most people want to get rich as quickly as possible, and bull markets invite us to try it. The Internet boom of the late 1990s and the CryptoCurrency bubble of 2018 are perfect examples.

According to an old saying on Wall Street that the market is driven by just two emotions: fear and greed. But seems not true.

In fact, Letting emotion govern your investment behavior can cost you dearly.

21. Not Discussing The Money Matters In The Family

Discussions related to money are considered as taboo in Indian families. Nobody really discusses money matters with family and close friends.

Since most financial decisions are taken by the bread earner or the head of the family so, the views of the spouse (usually the wife) are generally not taken into consideration.

This may be because the spouse lacks financial knowledge or interest in the financial affairs of the family.

But it is extremely important to include your next of kin while planning or reviewing your financial plans.

It is also advisable to keep your family aware of your:

- Bank Details

- Insurance Details

- Investment Details

- Your Loan /Debt details

- Asset Details (Property / Land papers)

22. Depending Upon Others For Investment Decisions

Unfortunately, a lot of people are dependent upon others with their hard-earned money. This is the reason we have a lot of self-proclaimed experts giving stock market tips.

Those may be biased or paid experts for influencing the investors. So the investment decision should be based on market analysis. It will take time to understand the market trend but good for you in the long run.

23. Considering Frugal As Cheap

A lot of people confuse economic spending with being cheap.

This is not always true that costly things have better quality and economic things are substandard.

An economic spender does not compromise with quality but does his research well enough to buy the product or service at the lowest rate.

24. Spending Too Much On Weekend Parties

5 days work and 2 days party: This is the new culture in the metro. Since we don’t have to work on Saturday & Sunday, hence it becomes a celebration of five days of hard work.

Pubs are jam-packed on weekends where people would spend a bomb on drinks. And by the end of the month, they are left with no money.

This culture is growing among the new generation and spending their money on weekend parties and night outs. Which is again not going to get your financial goals.

25. Getting Tempted To Go For An Exotic Vacation Just Because Someone Put A Photo on Social Media

Instagram, Facebook, WhatsApp & Twitter are introduced as Social Media platforms, but they are actually destroying the entire social fabric.

Facebook, Instagram, and Twitter are more of a marketing platforms where people post stuff just to get some likes and shares.

You can search the hashtag ‘travel’ on Instagram, and you would find almost 380 million results.

That is not exactly a new phenomenon since traveling has always been linked to our social and economical status.

I agree that leisure time and vacation are vital for the proper functioning of the human mind. And we need idle time to be productive and recover from work stress. But getting tempted for an expensive vacation by seeing others’ posts on social media is how going to affect your financial journey.

Over To You

I hope you found these tips informative and may help you avoid these common money mistakes.

Please let me know what mistakes you have committed. Also, add if I missed some points to cover.

I would love to hear your thoughts in the comments.

Cheers 🙂

Very useful 👌🏻👌🏻

Thanks, Sanjeev.

Glad that you found it useful.

Nice

Thanks Subodh

Thanks a lot for sharing this beautiful article on Financial Planning.

Thanks for your comments Chandra Shekhar.

Glad that you liked this article.

Very good option .and advice given